For folks who’d like to dive deeper into the intricacies of yield farming on Arkadiko, read on as I share my experience interacting with Arkadiko.Finance.

The front-end of Arkadiko Protocol went live at Stacks block 34620, after connecting your hiro web wallet, you’re greeted with a sleek UX where a tutorial prompt will walk you through the basic functions of Arkadiko. At launch, users are able to open a vault, swap digital assets, provide liquidity in pools and staking of DIKO.

*While Arkadiko has been audited by one of the top security firms in the space, exploits can still occur, thus do not invest more than what you’re willing to lose.

**The yield farming strategies that I’ve shared below are solely done based on my risk/reward tolerance, take into account your risk/reward tolerance before investing.

As a DeFi enthusiast, I waited for the launch intently and upon it going live I opened a vault, collateralizing STX tokens (while also checking the box to allow the protocol to stack my collateral) to mint USDA – This unlocks the self-repaying loan feature

During the launch, a spike in transactions occurred thus for my transactions to go through, I had to increase my transaction fees by 5x (scaling solutions are in the works and will solve this issue soon). However, during normal times the usual transaction fees (~0.1STX) are more than sufficient.

Armed with newly minted USDA, I added STX and a portion of my USDA into the first liquidity pool (STX/USDA) which has the largest liquidity mining rewards. To add liquidity to a pool, one would need to have both assets of the pool. E.g. STX/USDA pool would require you to add an equivalent amount in value of STX & USDA, and LP tokens are minted to indicate the amount of STX & USDA you’ve added into the pool.

*Note that by adding liquidity to pools, you’re exposed to impermanent loss if the price of the assets changes. Learn more about impermanent loss here. A summary to show impermanent loss vs hodling.

- 1.25x price change = 0.6% loss

- 1.50x price change = 2.0% loss

- 1.75x price change = 3.8% loss

- 2x price change = 5.7% loss

- 3x price change = 13.4% loss

- 4x price change = 20.0% loss

- 5x price change = 25.5% loss

However, in certain scenarios, fees earned from providing liquidity and the protocol’s liquidity mining incentives are more than enough to offset the impermanent loss that you’ve incurred. For users who’d like to provide liquidity, it is strongly recommended that you understand the concept of impermanent loss and calculate if the fees + rewards that you’d be receiving are worth the potential impermanent loss that you’d incur.

Separately I used the remaining USDA to swap for $DIKO tokens and added liquidity to the following pools. ⅓ of my $DIKO into STX/DIKO pool, ⅓ into USDA/DIKO pool, and received their respective LP tokens accordingly. The remaining ⅓ of DIKO tokens were reserved for DIKO staking.

*Due to the nature of providing liquidity which would expose your assets to impermanent loss, and DIKO being a new token that will enter its price discovery phase soon(higher volatility) I decided to diversify my DIKO tokens, reserving a portion of it for staking.

**Staking possesses its own risk as well, as per Arkadiko’s documentation, 30% of the DIKO staked with the protocol may be used as a backstop in the event of an exploit.

DIKO staking and DIKO rewards were not switched on at launch and instead were scheduled to begin at Stacks block 35300, allowing time for the community to position their assets before the rewards program.

Lastly, with the 3 LP tokens that I’ve gathered from adding liquidity to the pools, I went on to stake them in each of the yield farming options for DIKO rewards.

In the above step up, I’ve created multiple layers of yield generation built on a loan that will repay itself. 🤯🤯

The rationale for my above setup was:

I’m bullish on Arkadiko, thus I would like to get exposure to DIKO tokens. However, using all my USDA to swap for DIKO tokens seems to be an expensive option (if you’re not the first few who manage to swap $DIKO at the launch price of $0.55). Given that 50% of DIKO supply will be awarded to protocol participants, therefore I opted to only swap a portion for DIKO and be a liquidity provider in their pools to earn DIKO rewards.

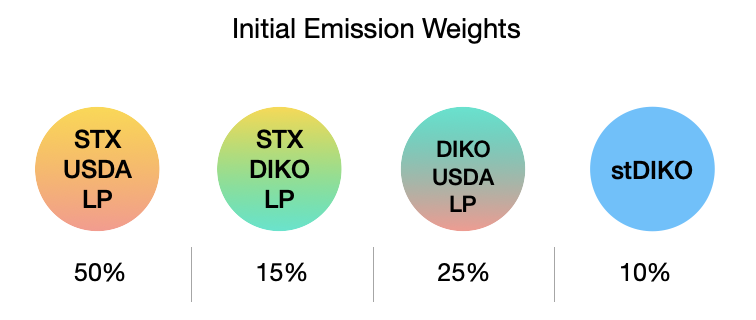

Most rewards are allocated to STX/USDA pool, however, TVL locked in STX/USDA is also the highest, thus it’s a scenario of you’re entitled to a smaller piece of a larger pie. Inversely, allocating to a smaller TVL pool you’re essentially getting a bigger piece of a smaller pie.

I chose to allocate to all pools to earn fees + DIKO rewards in all of them while also diversifying the inherent risk of one pool being exploited. Also the need to account for impermanent loss occurring in liquidity provision, I’ve allocated to a portion of DIKO for staking where any price changes to DIKO token is fully reflected on my staked DIKO.

Happy Farming!🚀