Internet is this amazing intangible thing that enables the world to be connected, and with every additional user connecting to it, its value increases exponentially. As for the new user who just gained internet access, it’s like opening an ever-expanding encyclopedia and a phone directory that allows you to connect with almost anyone across the globe, all packed into a device the size of your palm. The computing power you possess with this palm-sized device is multiple folds of what Apollo had when it embarked on its mission to send humans to the moon for the first time. It certainly sounds utopian to anyone who first hears about the internet and mobile computing, about the limitless possibilities this innovation can bring to mankind. It surely is, when the public first discovered the internet when the world wide web became mainstream, the euphoria kickstarted the dot com era, and a generation of new companies and business models were created that drastically improves our way of life.

The internet was originally used by the military, powered by ARPANET which subsequently adopted the TCP/IP protocol standards developed by Robert Kahn and Vinton Cerf. It was only when Tim Berners-Lee invented the World Wide Web which makes accessing data online easier in the form of websites and hyperlinks that we saw wider adoption of the internet. This initiated the digital revolution that we’re all part of as commercial use of the internet increases.

The key innovation of the internet was to enable information/data to be transmitted/replicated across the globe at little to no cost once the infrastructures are in place. Relatively fixed costs as public goods, but exponential value gain over time for any users/entities when the scale is achieved. This is where the telephone and fax machines fell short, while they enabled global connection, data transmission was expensive therefore usage was limited thus making innovation and new experiments on them prohibitive. With the internet, it enabled new business dynamics to occur such that a centralized vendor can facilitate a huge amount of activity over the internet with relatively light physical assets and bringing network effects to a global scale (where traditionally network effects have been limited by your physical geographic location).

Dotcom era

Dotcom era euphoria, seen by many as a financial disaster with stock prices plummeting and an abundance of fraudulent claims in the private/public markets with companies going bankrupt weeks/months after going public. However, to a certain extent such euphoria, while short-lived and had lasting implications on market participants that were involved, it accelerated innovation and attracted more talents into the industry. With the likes of Facebook, YouTube, LinkedIn, and more started after the dot-com crash, the euphoria certainly created more awareness about what the internet could be and thereby inspiring the next-generation technology companies to be built. Companies that survived the market boom and bust while keeping their heads down, constantly building and delighting their customers, emerged stronger. Some anecdote examples like Amazon, Microsoft, Apple, Google, Adobe Systems, Nvidia, and many more survived the dot-com crash and emerged stronger in their own ways thereafter. During the dot-com peak, the market overreacted too much over a short period of time to the potential the internet could bring to the economy, which led to a steep correction shortly after. However two decades on, we’re merely realizing the potential of the internet on a global scale from productivity gains, improved quality of life, unlocking new business value, etc, and companies surpassing their dotcom peak multiple folds with no signs of stopping. New emerging technologies are often overhyped in the short term but are underestimated in the long term. The possibilities might be infinite, but it requires, time, talent, and resources for these technologies to be built out and for the industry to mature.

Drawing reference from the dot-com era, the crypto industry witnessed its own version of boom and bust on multiple occasions during its short history (13years) with 2017 getting the most attention from mainstream media and the wider market. The euphoria that the bull market brought to the crypto industry certainly excites many and brought awareness to the industry. While it attracted bad actors and opportunist creating subpar/borderline fraudulent projects soliciting funds from the unintended, the awareness the euphoria created have also attracted talents, resources and infrastructures from other industries to be involved. While corrections after a euphoric market can be painful for participants if they are caught on the wrong side of the trade, looking back four years on, you’d realize that a significant number of folks were drawn into crypto due to the euphoria in 2017. Many stayed on to build/contribute to the wider crypto ecosystem, with various key infrastructures being built during the crypto winter of 2018-2019.

Web 3.0

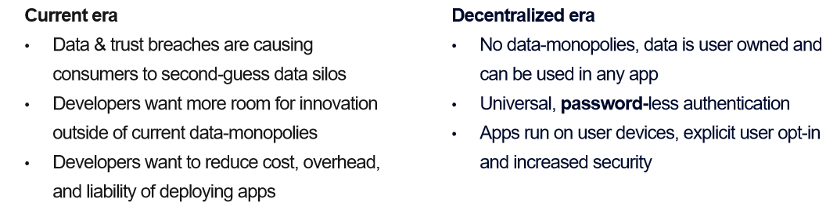

As more businesses build on top of the internet, value creation and value capture were done on top of the internet, as seen from the various big technology companies operating in the industry now. Value accrues to the gatekeepers of these key services (e.g. Data – online search, e-commerce marketplace, Mobile platform) that the general population has grown accustomed to. Over time, through sheer prowess in execution, deep understanding of the market, and strong balance sheet, these companies can fight off competition (or acquire them) to maintain their market position and expand into parallel sectors while gradually increasing their power in the market. Society is coming to terms with the dangers of Web 2.0 limitations, while the internet certainly improved our lives and increased our productivity, it presents a new set of challenges that needs to be overcome. Epic-Apple antitrust case and the other hearings of antitrust cases against Big Tech gave us hints of what is to come as companies build their ecosystem as walled gardens. Social Media companies in 2021 de-platformed the 45th President of the United States is treading on a very fine line of ethics, and have also shown the world that technology companies do have the power to censor users if they deem that there were violations in their terms of use. This creates a scenario whereby the services that big tech companies provide have become so entrenched in our daily lives that to a large extent many users rely on them for their daily livelihood. This changes the balance of power from end users to service providers, where creators, businesses become susceptible to any changes these platforms introduce, with little recourse.

This is where Web 3.0 strives to improve on, to build the next generation of the internet on an open infrastructure that is secure, private and data are fully owned by users, which eliminates the need for gatekeepers and allows more value to accrue to its end users. Blockchain technology offers the ability to do that as it does not require a third party to maintain trust in the system, such that users, stakeholders, and participants can interact directly with each other, facilitated by smart contracts, and settles the transaction in a trustless manner. A great analogy to illustrate this point would be, the inventor of TCP/IP or the creator of the world wide web couldn’t capture any value for their creation despite it being the key catalyst to unprecedented wealth creation for many other internet businesses. As applications and other product services begin building on open smart contract layers like Stacks and the Lightning network which uses the Bitcoin Network as the settlement layer it changes the dynamics where economical value can be created while being publicly accessible. Value accrues to the token of the network (bitcoin) as 1) demand for the Bitcoin Network increases, 2) Network Effects increases as more applications rely on the Bitcoin Network as the ultimate source of truth, along with other properties of bitcoin such as 3) Store of Value, 4) Hedge against currency devaluation and 5) Personal Sovereignty.