The Federal Reserve recently indicated that they will be keeping rates near zero at least until 2022 to help the US economy recover from the Coronavirus economic shock. Along with maintaining the pace of quantitative easing the Fed is doing through the increase in Treasury and mortgage-backed securities. The Federal Reserve balance sheet is at US$7.1 trillion for the week 8th June 2020, increased by US$3 trillion in the last 3 months.

While this situation isn’t unique only to the US, government across the globe have adopted aggressive stimulus plan to cushion the economic shock caused by the Coronavirus. So how would such actions affect the general population?

At a basic economic level, the interest rate set on savings account deposits is determined by the relationship between how much banks value receiving extra deposits and how much savers value the services of a savings account. Those valuations are manipulated by how governments and central banks target interest rates in the economy.

So for the average citizens whose, a large portion of their financial assets are kept with the banks, earning minimal interests over a long period of time will put themselves in a precarious position whereby their asset value will decrease over time due to inflation.

So what shall we do in a low-interest rate environment?

There are many options available, however the accompanying underlying risks may not be suitable for everyone. The following are a lists of options one can take, along with the underlying risks of each.

1) Keep your financial assets(cash) in a high-interest rate savings account/fixed deposit

2) Invest in REITs

3) Invest in Bonds

4) Invest in Stocks

5) Keep your financial assets(cash) in high-interest digital assets account

Fixed Deposits & Savings account

Keeping your financial assets in a savings account or fixed deposits could be one of the safest option available in the market. Deposits are insured by the government on varying amount, in Singapore the Singapore Deposit Insurance Corporation(SDIC) administers the scheme of insuring up to SGD75,000 per depositor per bank.

Below is a summary of the highest fixed deposit rates available in Singapore for the month of June 2020.

While the global inflation rate for 2020 is estimated to be around 2.99%, and historically inflation has always been above 2% for the last 10 years. With such low saving rates, your purchasing power will decrease over time as prices of products increases at a faster rate than the value of your money.

Investing in REITs

People see REITs as an alternative option to Fixed Deposits as it gives a higher rate of return, and a stable passive income for REITs holders. This is true to a certain extent, as commercial REITs have long term contracts with their tenants, therefore dividends distributed would be predictable thus appealing to investors who wants to have a passive income.

Here are some metrics one should look at when evaluating REITs,

1) Potential growth in distribution per unit

2) Gearing ratio

3) Dividend yields

4) Lease expiry of tenants

5) Strong sponsors

Here are some underlying risks that one should look at when evaluating REITs

1) Liquidity risk

2) Leverage risk

3) Market risk

While REITs is a good option for investors to fight against inflation, and build a portfolio of passive income, the knowledge required to select the right REITs for your risk profile may elude the masses. It can also be a challenge for local investors to evaluate foreign REITs and REITs are also susceptible to global economic crisis. An example of how an Indonesia focused REITs was affected by the pandemic.

Investing in Fixed Income(bonds)

Another alternative way to beat inflation is to invest in fixed income(bonds), while bonds are essentially debts that corporations take on to finance their operations while committing to repay them over a number of years at a pre-determined interest rate. Bonds are seen to be safer than equity because, in the event that a company goes under, debtholders have a right to claim of the remaining assets before shareholders, therefore bondholders are higher up the hierarchy in the event that a company defaults. While this is true, there are multiple risks a bondholder should consider before investing in bonds.

1) The financial soundness of the company issuing the bond

2) Interest rate risk

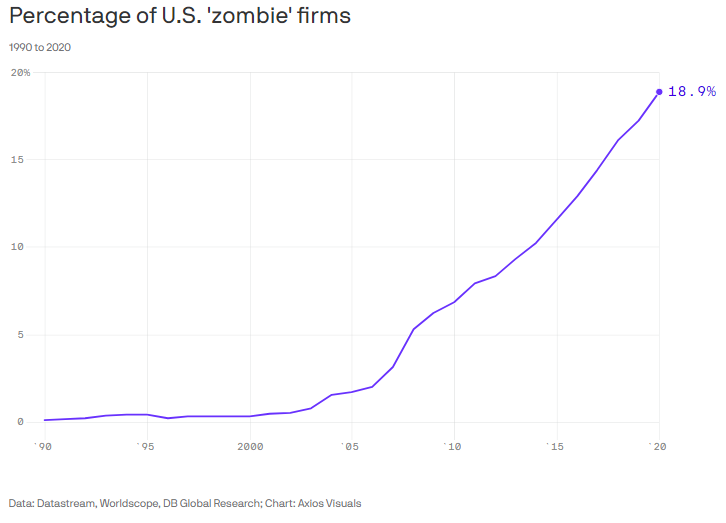

To make an informed decision on what bonds to invest in requires a certain level of financial know-how, to evaluate the strength of the company’s balance sheet and if these companies have the abilities to repay the loans that they take on. With the current pandemic, close to 20% of US companies are labelled zombie companies. Which is to say, the profits that they are making are insufficient in repaying the interests of the debt that they’ve taken, and the only way to continue operating is the take on more debts to service their loans.

Investing in stocks

Investing in stocks (high growth/dividend stocks) provides an avenue for investors to beat inflation, however there are multiple risks to consider when investing in stocks. An economic shock or recession will cause the stock market to decline rapidly, and the lack of proper financial management will result in investors taking on huge losses, despite after years of accumulating positive returns in the stock market. It requires financial knowledge, industry knowledge(to determine the growth potential of a company) and an analytical mind to determine when to take a position or close a position in the stock market. As ultimately what determines your returns are your entry and exit price, everything else doesn’t matter.

In addition to the high level of competency required to consistently outperform the market and beat inflation, the risks of fraudulent companies operating in the exchange to exploit investors. The recent fraud case of Luckin Coffee illustrates how companies are manipulating their stock prices through fake revenues, and creative accounting.

However, with recent innovation it makes stocks investing extremely accessible, which if not approached responsibly could be spun out of control. In a recent case, both Hertz and Chesapeake but both companies saw their stock price rallied to historical high, despite the financial troubles that they are facing. Hertz share price increased from 56cents to $5.53 in two weeks, and stocks of other near-bankrupt companies—J.C. Penney, Chesapeake Energy—have also rallied in the past few weeks. Robinhood, a fintech startup which made stock trading easily accessible to the Millenials and charges zero commission for trading have contributed to these insane speculations in the stock market. Thus approach stock investing with care, be rational and don’t get caught up with the hype of FOMO, patience is your utmost edge in the market.

High-interest digital asset account

Digital assets like Bitcoin are seen as a potential store of value due to its various properties, due to its finite number of units, the network is decentralized enough to offer security to holders, and it can be used to hold and transfer value. However, it must still prove its worth as a safe-haven asset – it’s too early to say for sure as the asset is still in the exploration stage where the volatility is extremely high. Given the volatility in price, stablecoins such as Tether, USDC were introduced to allow payments on the blockchain where it is usually backed by US dollars or a basket of assets, to ensure minimal volatility.

This is a relatively new area of finance as compared to the previous 4 methods that I’ve shared above, and few would have heard or known about digital assets or its underlying mechanics. Since the inception of Bitcoin in 2009, the blockchain/digital assets industry have developed tremendously.

From a medium of exchange largely used by criminals to evade detection to an industry that’s pushing the forefront of fintech innovation and partnering with government across the world to leverage on blockchain technology to make the world a safe place. With various central government having plans to release their digital currencies on blockchain is a sign that the industry the progressing in the right direction.

So how can digital assets help you beat inflation?

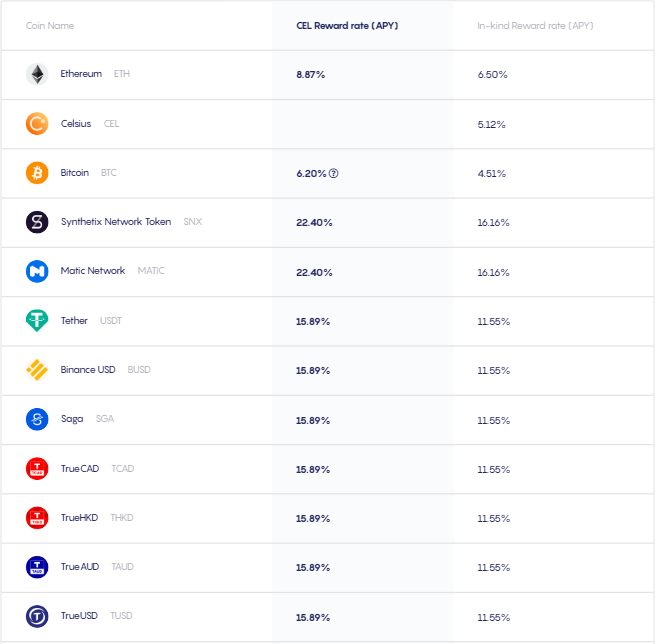

This is where Celsius Network operates, it harnesses blockchain technology to provide unprecedented financial freedom, economic opportunity, and income equality, giving out interest rates of 3% – 10% on your digital assets, just like how a bank would give you interest on your deposits.

But it is almost unheard of in recent times that banks are paying out more than 2% in interests to their depositors, so how can Celsius do it?

In actual fact, most banks typically have between 14–25% return on their capital, so by paying customers 1% in interest, they’re keeping over 80% of the profits and distributing these earnings to their shareholders, usually in the form of dividends and share buyback.

The Celsius business model is structured to do the exact opposite of what banks do — by giving 80% of total revenue back to Celsius community each week in the form of earned interest. Celsius earn profits by lending coins to hedge funds, exchanges, and institutional traders, and by issuing asset-backed loans at an average of 9% interest. By taking the exact same 80% profit margin that banks have kept for themselves for centuries and returning it to Celsius community of depositors.

High interest digital assets account do have its underlying risks as well,

1) Account hacks

2) Intricacies of navigating through cryptocurrencies(Celsius made onboarding extremely easy)

3) Custodian holdings of your digital assets

However, I see services like Celsius Network as another form of inflation-beating mechanism, amongst the many others as described above. This allows the average investors to diversify their risks and based on their financial situation storing their assets in a different medium to maximise returns.

While comparing to a savings account provided by a bank where interest rates ranges from 0.8% – 1%, Celsius is giving out 4% – 5% interest rate on Bitcoin/Ethereum and ~11% on USDC/Tether(stablecoins). That is a deposit of $1,000 worth of USDC on Celsius, the interest earned is equivalent to $10,000 deposited in a fixed deposit in a bank.

Thus in my view, diversifying a small portion of your savings onto Celsius network allows you to maximise the returns that you’ll be getting, while at the same time keep risks low.

You can sign up to Celsius Network here, or to use the referral link where we both earn US$20 in BTC each.